Some of the best credit card sign-up bonuses in existence are tied to the Chase Ink business credit cards.

At last glance, you earn up to 100,000 points from Ink Business Preferred. And it only has a $95 annual fee.

Take that Amex Platinum and your $695 annual fee.

But there are two even better Chase Ink cards that come with 90,000 bonus points and way lower minimum spend.

Chase Ink Cards Currently Offer 90-100K Points Each!

Currently, there are four different flavors of Chase Ink business cards, including the following versions:

- Ink Business Cash (no annual fee, 90k points)

- Ink Business Preferred (100k points, but high min. spend and annual fee)

- Ink Business Premier (100k points, but can’t transfer points)

- Ink Business Unlimited (no annual fee, 90k points)

In the past, there was also the Chase Ink Bold and Chase Ink Plus.

The newest version is “Ink Business Premier.” It comes with 100,000 bonus points when you spend $10,000 in the first 3 months.

That’s a pretty daunting minimum spend, as you’ll need to average $3,333k per month to hit the bonus.

Additionally, it has a $195 annual fee, which is about double the usual $95 annual fee on Ink cards.

There’s also the Ink Business Preferred, which offers 100,000 Ultimate Rewards points and a lower $95 annual fee.

But it requires credit card minimum spend of $15,000 in 3 months, or $5k per month.

Neither are the best offers available.

Ink Business Cash and Ink Business Unlimited Are the Best Offers

Turn your attention to Ink Business Cash or Ink Business Unlimited.

Both offer “$900 bonus cash back” if you spend $6,000 in the first 3 months.

Aside from the lower spending requirement, neither has an annual fee. $0!

So you get to spend less, pay nothing to hold the card, and earn a similar amount of bonus points.

They also offer cash back multiples. Unlimited offers 1.5% cash back on every purchase.

And “Cash” offers 5% at office supply stores, on internet, cable and phone charges (up to $25k per anniversary year).

The one caveat is neither card earns higher redemption rates when Ultimate Rewards are used for travel.

Nor can the points be transferred to airline/hotel partners. However…

Make Sure Points Transfer to a Premium Chase Card

The real value in Chase’s Ultimate Rewards is the ability to transfer points to airline and hotel partners.

So-called “premium Chase cards” that allow these transfers include:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Business Preferred

While Ink Business Cash and Ink Business Unlimited don’t have annual fees, they also don’t allow transfers to partners.

They aren’t premium Chase cards. But here’s the good news.

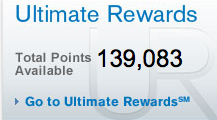

You can pool your points if you also hold a premium Chase credit card such as Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred.

Simply combine your points from your basic Chase cards to the premium Chase cards and they’ll go a lot further.

Tip: The big downside to the new Ink Business Premier is it doesn’t allow you to transfer points to a premium card.

Thus, those points are only good for cash back redemptions and other basics.

Should You Apply for Both Chase Ink Cards?

You might have come across the four Chase Ink cards only to ponder which you should apply for.

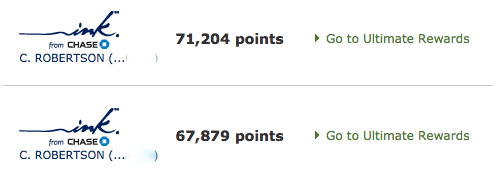

With bonus offers this good, it could make sense to apply for two, or even three!

After all, why settle for 90,000 points when you can get 180,000+ instead?

The caveat is that you need to do double the spending to qualify for both bonuses.

And you need to get approved for both versions of Chase Ink, which could require some explaining on your part.

But let me tell you how I did it and why it can make perfect sense.

First I Applied for Chase Ink Bold

When I applied for the Ink cards, they were offering 60k bonus points, so I could easily earn a minimum of 130,000 points simply by meeting the $5,000 spending requirement on each card.

I went with the Chase Ink Bold first somewhat arbitrarily. It was a charge card, meaning you have to pay off your balance in full each month.

In hindsight, it may have made more sense to apply for the Chase Ink Plus first, seeing that it’s a credit card, and then apply for the Bold.

The logic is that a charge card doesn’t give you the option to carry a balance, so Chase isn’t taking as much risk with you.

Conversely, you could argue that you have the Bold, and now want the credit card flexibility of the Plus, so that order makes sense as well.

And credit card limits can be shifted (unlike charge cards), so if you already have a Chase business card, you could move a portion of an existing credit line to Ink Plus for much easier approval.

Either way, you’ll want to have good credit, a solid business, and solid numbers to back up your business.

There’s a good chance you’ll get sent to the reconsideration line when applying for one or both of these cards, so be prepared to answer relevant questions about your biz.

Anyway, I got approved for Chase Ink Bold and quickly spent the $5,000 needed to get the bonus.

Tip: Don’t just spend it all on gift cards and at office supply stores. Put your utilities on the card, use it at grocery stores, restaurants, and for other everyday purchases.

If you don’t, it could hurt your chances of getting a second Ink card later.

Then I Applied for Chase Ink Plus

Only about two months (if that) after applying for Bold and meeting the minimum spend, I applied for Plus. I knew I’d have some “splaining to do” given the short time span between applications.

Sure enough, I got that infamous account is being reviewed page, so I immediately called Chase and got prepared to answer some questions.

They asked about my business and income and why I wanted another Ink card. I just explained that I had the charge card but wanted the flexibility of a standard credit card.

After a bit of back and forth, I was approved for my second Ink card within months. Sweet! Another 60k bonus points on the way.

Remember, I was using my first Ink card for all types of REAL purchases, so that probably helped. It didn’t just appear as if I was trying to get the bonus before bolting.

Additionally, I paid off the full balance on the Ink Bold card before applying for my second Ink card to show them I could and will pay on time.

You Can Get All 3 Chase Ink Cards (Maybe Even 4)

While it’s possible to get 2-3 Chase Ink cards, I’m not sure if you can get all four varieties.

However, I’d probably pass on Ink Business Premier since points can’t be pooled for premium redemptions, even if you have another premium Chase card.

If you do go for 2-3 Ink cards, try to space out the applications. And have it make sense.

Be prepared to answer questions. Take note of the differences in each card.

Maybe you want Ink Unlimited for everyday spending (1.5% back on all purchases).

And perhaps you want to add Ink Cash for its 5% cash back categories.

You could also apply for Ink cards under two or three different businesses you own to mix things up.

Either way, you’ll want to prove yourself worthy with your first Ink card before getting another. Otherwise you’re just setting yourself up for failure.

There’s also the 5/24 rule to worry about, even though the Ink card won’t count in the tally.

That means applying for Ink cards while under 5/24 is the way to go, before five personal cards ruin it for you.

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

- Best Gas Credit Cards – Earn Up to 8X Points! - February 15, 2023