Let’s take a closer look at the credit card Money Magazine called the “Most Rewarding Card if you crave free airline flights.”

First off, “Capital One’s Venture Rewards credit card” is a travel rewards credit card. So if you don’t travel often, you may want to look at another card.

Also note that you need so-called “excellent credit” to get approved for this credit card, which is yet another reason why you should stay on top of your credit.

Of course, their definition of excellent credit might differ from other issuers, so it may not really be that hard to get approved for this card.

Per Credit Karma, customers are getting approved with credit scores in the mid-to-high 600 range.

The bigger worry might be a possible 5/24 rule on Capital One credit cards.

Capital One Venture Rewards

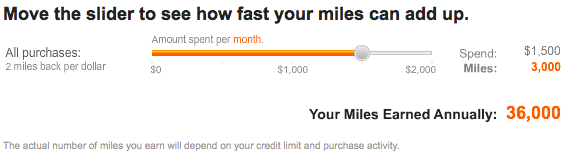

On to the rewards…you get two miles per dollar on every purchase made with this card, hence the “double miles” phrase Capital One often throws around.

Additionally, you get a one-time bonus of 10,000 miles if you spend $1,000 in the first three months as a card member, which is worth $100 in free travel.

You can also earn 15 extra miles per dollar spent if you shop in the Perk Central retail network, which consists of a variety of top retailers.

The “miles” can be used for any travel expense, including airline tickets, hotel rooms, car rentals, vacation packages, and more.

There are no blackout dates, no limit to how many miles you can earn, and your miles do not expire.

You can fly on any airline you choose and buy your tickets anywhere (such as a cheap online travel website). Once you find the best deal, simply use the Venture Rewards card to book it, then redeem your miles online or by phone to get reimbursed.

Once you do so, you’ll be credited for the purchase and you will see a credit on your statement.

It’s very simple to calculate how much you’ve earned with the Venture Card. Simply add two zeros to your travel costs to see how many Venture Rewards miles your travel will cost.

For example, if a flight costs $500, you’ll need 50,000 miles to get that flight for free.

As you can see, if you spend $1,500 a month on your Venture Rewards credit card, you’ll earn 36,000 miles annually, which is worth $360 in travel.

Miles can also be redeemed for cash, gift cards, merchandise, and more, though the rates for these redemption options vary and are subject to change. In other words, the value per mile is cut in half generally.

Also note that these are fake miles because they aren’t actual airline miles, just credit card points that you can use toward travel at twice the normal redemption value.

Double Miles Challenge

Capital One is also currently offering a so-called “double miles challenge,” where they will give you double miles on your 2011 purchases made with a competing travel rewards credit card.

So if you spent $50,000 last year on your American Express Blue Sky credit card, then switch to the Capital One Venture Rewards card, they’ll credit your account with 100,000 bonus points, which is good for $1,000 in free travel rewards.

All you have to do is spend $1,000 within the first 90 days of cardmembership, and send them a year-end summary from the old travel rewards credit card for verification purposes.

*This is only good for new Venture Rewards cardholders, and Capital One is only giving out one billion bonus miles. The bonus ends May 1st 2012, or as soon as miles run out.

The Venture Card Numbers

The Capital One Venture card comes with a $59 annual fee, though it is waived for the first year.

Both the purchase credit card APR and balance transfer APR are a variable 11.9% – 19.9%. The cash advance APR is a variable 24.9%.

There isn’t a balance transfer fee, but there’s not much sense in transferring a credit card balance to such a high interest rate when there are plenty of 0% APR credit cards out there.

The credit card grace period is 25 days on purchases.

Finally, there is no foreign transaction fee on the card, which is a perfect fit for a travel rewards credit card.

All in all, the Venture Rewards card seems to be a good deal. It has a relatively low annual fee, a better than average rewards program, and some nice perks.

It’s probably also easier to get approved for than other credit cards in its class.

At the same time, you may be better off with a pure cash back credit card that will help you earn more money in the long run, especially if it has a handsome opening bonus.

Alternatives to Venture Rewards

If you don’t want to pay the annual fee, but like what you see, Capital One also offers the “VentureOne Rewards Credit Card.”

It has no annual fee, but only allows you to earn 1.25 miles per dollar on every purchase.

However, you still get the benefit of avoiding foreign transaction fees without paying an annual fee, which is certainly a plus.

Also take a look at the American Express Blue Sky credit card, which offers similar benefits and the unmatched customer service only American Express can deliver.

If you travel domestically, there’s also the Southwest credit card, which comes with $400 in free flights after you make your first purchase!

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

- Best Gas Credit Cards – Earn Up to 8X Points! - February 15, 2023