Credit Q&A: “How many credit inquiries is too many?”

Though most credit score questions are hard to nail down, thanks in part to the cryptic nature of credit scoring, we can get some useful hints if we look at certain data.

Do the Credit Inquiries Matter?

First things first, there are two types of credit inquiries. Hard and soft.

Hard credit inquiries involve applications for new credit, so they can lower your credit score, as new credit presents new default risks.

Soft credit inquiries, on the other hand, don’t involve requests for new credit, and thus have no adverse effect on your credit score (Does a credit check lower your credit score?).

While there is not a set number of credit inquiries that you should aim to stay below, it’s generally best to keep hard credit inquiries to a minimum to ensure your credit score is not negatively impacted in any way.

I recently did a Credit Karma review, which happened to come with a wealth of insights on credit scoring, one having to do with credit inquiries.

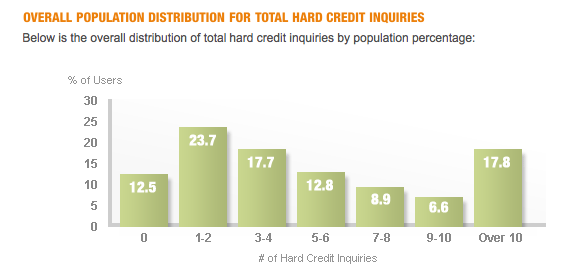

Check out this chart, which compares all users and their average number of hard inquiries over the past two years:

You’ll notice that most consumers were in 1-2 credit inquiries range, though a large chunk of consumers had over 10!

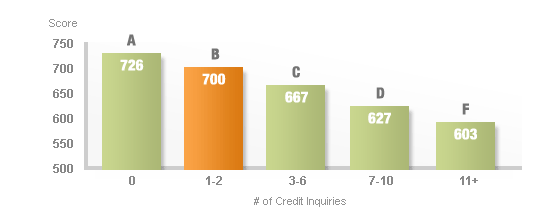

Now take a look at this chart, which shows the average credit score based on the number of hard inquiries:

More Credit Inquiries = Lower Credit Score

As you can see, those with zero hard credit inquiries had the highest credit scores, followed by those with 1-2, and on down the line. Amazing correlation. In fact, it’s 100% correlated, which is pretty rare to see in any data set.

So I think it’s safe to say that the fewer hard credit inquiries you have, the higher your credit score will be, though new credit is still a relatively weak determinant compared to other factors like on-time payments.

So it’s unclear if this is just coincidental, or indicative of other credit habits. In other words, perhaps those who apply for new credit sparingly also tend to make on-time payments, while those who apply for new credit constantly also fall behind on their existing obligations.

Questions like these illustrate how complicated the credit scoring game is to nail down. But credit scores aside, you shouldn’t apply for too much credit anyways. It could land you in hot water at some point down the road if you manage to overextend yourself.

Read more: How a Fico score is determined.

(photo: teosaurio)

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

Hi

I have 8 inquiries, I don’t have judgement on my name though. I am trying to boost my credit scoring, what can I do. I have tries to open new account at Foschini but my application was declined because I am a slow payer even though I have settled all my accounts into a zero balance. what can I do now, I really need to work out this. I spoke to another lady who advise me to open new account, she said that might help to speed out to increase my credit scoring but I don’t see that helping as application is declining. I only have 1 account that is still active, it’s a debit order. I don’t have any missing payment. kindly advise the next step that I can take to increase my scoring.

Your assistance will be appreciated

Regards

Lulama

Hi Lulama,

It can be a catch-22 because having several open accounts in good standing can boost you score, but it’s hard to get approved if you don’t have good credit. Generally, the way around this is applying for credit accounts that you know you can get approved for first, perhaps for those with limited credit, then working up to the harder accounts once you’ve established your credit.