Credit card Q&A: “When will the credit card sign-up bonus post to my account?”

These days, mega credit card sign-up bonuses are all the rage, but one question I get a lot is when the bonus points (or cash) will actually post to the account?

It’s a good question because I know folks are anxious to get their hands on their rewards ASAP, but it does depend on the issuer, and sometimes the card.

Typically When Your Statement Closes

The most common time for rewards, including sign-up bonuses, to post to your account is when the statement closes following the spending requirement being met.

For example, say you applied for the Chase Sapphire Reserve and spent the required $4,000 during your second statement period, which has a statement closing date of August 10th.

Within a day or two you’d likely see all those Ultimate Rewards hit your account. This is great news for those who just completed spending a few days earlier, but perhaps a bit annoying for those who hit the minimum spend in the first few days of the billing cycle and had to wait awhile.

It’s even worse news for those who spent $3,900 through their August 10th billing statement, then had another $100 go through in the September statement.

Of course, you probably shouldn’t try to time your sign-up bonuses that closely. Sure, we’re all excited to get our rewards, and always experience that moment of paranoia that for some reason we may not get our bonus.

But if you chill out and focus on other things you probably won’t even notice if your bonus posts this week or next.

More importantly, if you plan to transfer your points to a travel partner, be really careful because as noted above, the timing of the bonus hitting your account can vary widely.

American Express Bonus Policy

Amex says: “Points will be credited to your Program account within 6-8 weeks after you have met the spending requirement.”

This is a boilerplate response I got via their online chat today. You could tell the rep was super excited to give me a great, indisputable answer to my question.

But in reality, you typically don’t wait two months for your Membership Rewards to post. It’s generally days if not instant. Of course, Amex issues a lot of different cards, so it may be somewhat card-dependent.

When I hit the minimum spend on my Amex Premier Rewards Gold, the 50,000 points posted instantly, even though the spending happened just days into my second statement period. So it appears you don’t have to wait for the statement to end.

Barclaycard Seems to Be Almost Instant

Barclaycard is even faster, at least when it comes to their Arrival Plus World Elite MasterCard. The points tend to post almost immediately after you hit the spending requirement. Can’t ask for much more there.

Can’t say the same about their other co-branded credit cards, which probably post once your statement closes.

I have the JetBlue credit card and the 60,000 bonus points haven’t posted yet despite hitting the required $1,000 in minimum spend. The points for the regular spending are available though.

Will update once the bonus points post.

Capital One Bonus Points Appears to Be Instant

Then there’s Capital One, which seems to post cash back bonuses almost immediately after hitting minimum spend.

For example, I recently applied for the Capital One Spark for Business card to snag the $1,000 bonus after $10k in spend.

I literally spent the required amount of money on a Tuesday and the cash back was waiting and available for withdrawal on Thursday of that same week.

Can’t complain about that!

When Will Chase Deposit My Bonus!

Chase tends to post your sign-up bonus after you meet the spending requirement and that associated statement closes.

As I illustrated above, it can be just a few days, or a few weeks depending on where you’re at in your billing cycle. Again, don’t go nuts trying to time it perfectly. You could get burned and miscalculate or have purchases spill over into the next billing period.

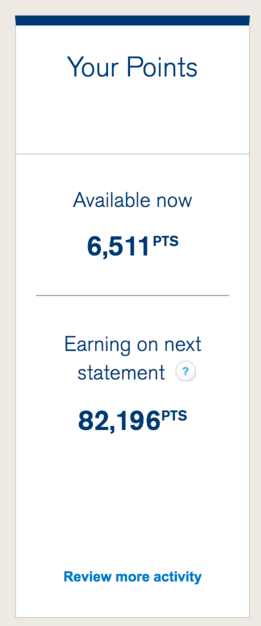

You can actually see where you stand with Chase now if you log-in to their revamped website and click on the Ultimate Rewards tab.

Then select your card (if you have multiple cards like I do), whether it’s Chase Sapphire Reserve or Chase Ink Preferred, and you’ll see “Your Points.”

It will show you what you’re due to earn on your next statement. This is a quick and easy way to see if you’ve met the min. spend and when the points will post.

As you can see, I’ll be getting 82,196 points when my Chase Ink Preferred statement closes soon. Instead of guessing, I know when my Chase Ultimate Rewards points will post. And I don’t have to badger anyone in the process.

Bonus: Chase checking account bonuses tend to post to your account nearly immediately once you receive your first direct deposit, assuming that’s what you needed to do to earn the bonus.

Their savings account bonus takes 90 days because, well, funds have to be in your account for 90 days. No getting around that one.

Citi Tends to Post Points After Your Statement Closes

Citi seems to follow a similar policy of Chase, with sign-up bonus points hitting accounts at the end of the billing cycle in which you met the minimum spend.

So if you’re able to muster that massive $7,500 in spending on the revamped Citi Prestige with the 75k bonus, expect your ThankYou Points haul when your statement closes.

And don’t get that one wrong – it would be very unpleasant to spend $7,000 and not get the bonus…those annual fees don’t count toward the bonus so do the math right!

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023