The JetBlue credit card from Barclaycard is currently offering its highest sign-up bonus ever, a full 60,000 TrueBlue points when you spend a mere $1,000 in the first 90 days from account opening.

This is double the normal offer of 30,000 TrueBlue points for the same spending requirement and annual fee. In other words, you might want to jump on this sooner rather than later before it disappears.

What Can 60,000 TrueBlue Points Get You?

- With the 60k sign-up bonus on the JetBlue credit card

- It’s possible to eek out two round-trip flights across the United States

- And still have points to spare for a fifth segment

- You also get one free bag when booking the cheapest “Blue” tier ticket if you have the JetBlue credit card

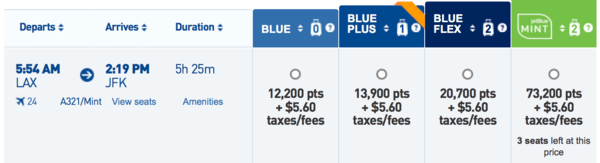

Seems like a pretty good deal considering flights from LAX to NYC can only set you back 12,200 TrueBlue points one way.

That actually works out to 5 segments exactly when you consider the points you earn for the $1,000 in spending.

Broken down, you get at least 1,000 TrueBlue points for the $1,000 minimum spend, then the 60k points for hitting the bonus. Those 61k points divided by five equal 12,200.

In other words, you can fly from LAX to NYC twice round-trip, and then tack on another one-way flight. Not too bad for a card that only charges a $99 annual fee.

Then you’re just on the hook for some taxes, which seem to be pretty incidental.

If you want to be a big shot, you can splurge and use all your points to go in Mint class, which features lie-flat seats. I’m seeing redemptions around 73,200, so you’ll need to do a bit more spending or have existing TrueBlue points in your account.

JetBlue Amazon Bonus Points

- You can also earn bonus JetBlue points

- Via the ShopTrue online shopping mall

- Or the TrueBlue Dining program

- And on Amazon purchases made in-flight (hint: buy gift cards with your JetBlue credit card while in the air)

Another way to quickly boost your TrueBlue account is to shop on Amazon using their link. First you go to www.jetblue.com/amazon, then you click “Shop and Earn,” then you do your shopping on Amazon as you normally would.

Just make sure items aren’t already in your cart to avoid missing out on the points. And be sure you’re not already logged into the JetBlue website when you start the whole process each time or you won’t see the Amazon link.

Update: You can now only earn bonus points on Amazon shopping while doing so on a Jetblue flight. This sounds crazy, and it kind of is, but if you just buy gift cards, you can take advantage of it with ease.

There’s also the ShopTrue online shopping mall, which actually allows you to earn points online without having to be 30,000 feet in the air.

And you can earn bonus points via the TrueBlue Dining program when you dine at participating restaurants.

In other words, it’s easy to earn points every day, and JetBlue offers rebates on rewards flights. So your points balance can grow quickly again.

JetBlue Plus World Elite MasterCard Offers 6-2-1 Points Earning

- Earn 6 points per dollar spent on JetBlue purchases

- Earn 2 points per dollar spent at restaurants and grocery stores

- Earn 1 point per dollar elsewhere

- There is no limit to how many points you can earn and they don’t expire!

There is no limit to the number of TrueBlue points you can earn and they do not expire.

Along with the decent point earning categories, the JetBlue Plus World Elite MasterCard comes with some nice benefits like that awesome sign-up bonus.

You can also book the lowest JetBlue ticket class known as “Blue” and get one free checked bag thanks to the free first checked bag benefit. I don’t know if you get this when paying for your flight with TrueBlue points though.

Additionally, you get 5,000 TrueBlue bonus points on your cardmember anniversary each year. If you consider a JetBlue transcontinental flight is as little as 12,200 points, it’s decent value.

To make redemptions on JetBlue even sweeter, you get 10% of your points back when you redeem. So if you book that flight for 12,200 points, you’ll be credited back 1,220 points.

You also get 50% off in-flight purchases like food, cocktails, JetBlue movies, and so on. For the JetBlue frequent flyer, it’s definitely good value.

Another perk is the $100 statement credit if you purchase a Jetblue Getaways vacation package valued at $100 or more, which can be exercised each calendar year.

Lastly, the JetBlue Plus credit card doesn’t charge foreign transaction fees, handy if you have plans to travel abroad.

All these features in exchange for a $99 annual fee, which is not waived during the first year.

For the record, the card does offer a 0% APR balance transfer for the first 12 months if its posts to your account with 45 days of opening, but there is a 3% fee.

And I never like to mix new purchases and balance transfers, especially when the purchase APR is not 0%.

Big Spenders Qualify for JetBlue Mosaic

If you happen to spend at least $50,000 on the JetBlue credit card in a calendar year (January through December billing statements), you qualify for a program called Mosaic.

It unlocks a ton of additional benefits, including the following:

- JetBlue change/cancellation fees are waived

- 1st and 2nd bags fly free regardless of fare class

- 15k bonus points

- Expedited security line

- Early boarding

- 9X points on JetBlue purchases

- Free drinks on Jetblue flights

- Dedicated customer service line

The JetBlue Card Is the Annual Fee-Free Inferior Version

- There’s also an annual fee-free JetBlue credit card

- But that version comes with a much lower 10k sign-up bonus

- Which might not get you anywhere, literally

- It also only earns 3-2-1 rewards in the aforementioned categories

I should add that there is a $0 annual fee version of the card known as “The JetBlue Card” that comes with a rather low 10k sign-up bonus for the same $1k spending requirement.

It earns 3X on JetBlue purchases, 2X at restaurants and grocery stores, and 1X elsewhere.

Additionally, it lacks the anniversary bonus, checked bag benefit, but maintains the in-flight savings and lack of foreign transaction fees. So it’s not terrible, it’s just kind of silly not to go for the 60k points for the same spend.

You can always downgrade to the free version of the card later if you don’t want to keep paying the annual fee. But paying $99 for one year seems like a no-brainer of a trade-off for 60k TrueBlue points.

In summary, this highest ever 60k sign-up bonus is hard to pass up. If you have any plans to fly across the states, this is a pretty valuable offer. Or if you simply fly anywhere JetBlue flies, you can get great value out of the offer.

Tip: Steer clear of the 30k sign-up offer that is still being featured prominently on many websites, including the Jetblue website. Make sure the application page displays the 60k bonus.

Why I Got the JetBlue Credit Card

I applied for the JetBlue credit card while the sign-up bonus was a staggering 60,000 bonus points for spending a very easy $1,000.

While the 60k offer will undoubtedly come and go, it’s kind of hard to pass up if there’s any possibility you might fly on JetBlue in the near future.

Even the more common 40k sign-up bonus is a good deal in my opinion.

The reason I wanted the card was to complete a trip to Europe, as I was flying from New York despite living in Los Angeles.

So the JetBlue points were enough (and then some) to fly my family from LAX to JFK for free.

I then used the annual airline credit from my Amex Platinum to upgrade our seats to the Even More Space seats on our flight.

And I’ve got leftover points to use for a future trip, perhaps a domestic flight to Utah during ski season.

(photo: Cory W. Watts)

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023