While it generally makes sense to raise credit lines periodically to increase your available credit and credit utilization, it can also backfire if you aren’t responsible.

Some credit line increase requests count as hard credit inquiries, which will be documented on your credit report for two years, and count against your credit score for one year.

Though the impact may be minor, a 5-10 point hit could still drop you into a lower credit score tier, costing you money on the next loan you take out (or an outright approval).

In fact, other creditors may even shy away from offering you new or extended credit because of your recent line increase/request.

Think of it this way. If you request a credit line increase, and then a month later decide you want to apply for a new credit card because it offers 0% APR for 15 months, the card issuer may decline your application because of that prior credit limit increase.

The way the card issuer sees it, you just applied for more credit a month ago, and for that reason you’re deemed a higher-risk applicant, at least for the time being.

Does a Credit Line Increase Affect Your Credit?

- Having more available credit can increase your credit scores

- This is the result of a lower credit utilization ratio, which credit score providers like FICO see as a positive

- But you might see an initial dip in scores after making a request if it results in a hard inquiry

- The good news is you should see higher scores long-term if you don’t spend any more than you normally do

If you recently got a new job, increased your income, or just feel your existing credit card limit is just too low, you might look into raising it.

This is pretty easy to accomplish nowadays, as most credit card issuers’ websites have an online tool to make the request.

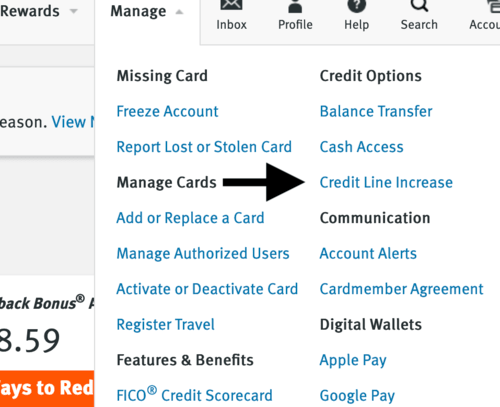

For example, if you have a Discover credit card, simply log on, then click on “Manage,” then click “Credit Line Increase.”

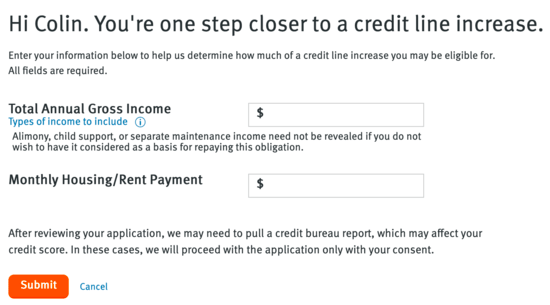

From there, you just have to answer a couple of basic questions related to your income and monthly liabilities and you might get your increased limit instantly.

Note that they do say it’s possible a credit report might be ordered as a result, which is where the hard inquiry comes into play.

But this isn’t the case with all issuers – Capital One says on its website that “requesting a credit limit increase will not result in a hard inquiry.”

In any case, the presence of a hard inquiry isn’t the end of world, though there are times when it’s best to avoid adding one to your credit report.

Like if you plan to apply for a mortgage or another important loan in the near future.

It’s also possible to be denied when making your credit line increase request – there’s no guarantee it’ll go through, similar to getting approved for a credit card.

Additionally, the credit card issuer may ask for income documentation to verify that you actually make what you say you make every year in order to approve the increase.

For the record, Discover tends to have notoriously low starting credit limits, so I’ve requested increases in the past just to avoid a situation where even everyday purchases raise my credit utilization rate above what I feel is an acceptable level.

Don’t Increase Your Outstanding Debt in the Process

- An increased credit limit isn’t an invitation to spend more

- You should pay off all your credit card bills in full each month regardless of the limit

- If you wind up spending more you could actually hurt your credit scores

- And it could cost you more money as a result of increased finance charges

Assuming your request for a larger credit limit is approved, don’t take it as an invitation to spend more.

Sure, you may have made the request so you can put some large purchases on your credit card temporarily, but be sure to pay them off quickly to avoid an even larger credit hit.

After all, maxing out your credit card can be nearly as bad as a missed payment as far as your credit score is concerned.

It also doesn’t make sense to pile charges onto a card that has APR greater than 0% as the associated finance charges will get pricey in a hurry.

Instead of requesting a credit line increase for this purpose, you may want to consider opening a new credit card that offers introductory APR for a certain period of time, such as 12-15 months.

That way you’ll have more credit at your disposal, and you’ll be able to carry a balance without incurring any finance charges.

Also consider a new credit card with an opening bonus – if you have a big purchase in mind, it can be a great way to meet a minimum spending requirement.

How a Credit Limit Increase Can Benefit You

- It all has to do with credit utilization, which will go down if your credit limits go up

- You should aim for a credit utilization rate below 30% on all your credit cards

- This only works if your spending stays the same or declines with the new limit in place

- Note that it may take time for the higher limit and lower utilization to reflect in your credit history (and score)

While I focused largely on the pitfalls of a credit limit increase, there is the potential to see your credit score increase as a result, it just might take some time.

Let’s assume your existing credit line is $10,000 and your outstanding credit on the card is currently $5,000. This would give you a 50% credit utilization ratio, which is higher than you want it to be.

If you make a request for say a $15,000 credit limit and the card issuer obliges, your credit utilization will improve to roughly 33%, which will give your credit score a boost as time goes on.

This is the case even if your outstanding balance doesn’t change because more available credit will mean your less of a credit risk.

Sure, you’ll want to pay off that balance sooner rather than later, but both FICO and VantageScore consider available credit when calculating your score.

Simply put, the more available credit you have, the better off you’ll be in their eyes, and they’ll reward you with a higher score.

Remember, it’s not always necessary to bump up your credit line, especially if you’ve already got a decent percentage of credit available.

And never raise your credit lines before or while applying for major loans like mortgages and car loans, as you could jeopardize that more important financing.

Read more: What credit limit can I get with my income?

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

- Best Gas Credit Cards – Earn Up to 8X Points! - February 15, 2023

And that’s the key – don’t increase your debt along with it. Great advice Colin!

I heard there’s a way to get American Express to triple your original credit limit. Do tell.

Lynn,

That seems to be the rumor. If you want to try, you can login at the Amex website, click on profile, then click on credit management, then click on increase line of credit. You’ll then need to enter the four digit code from the the front of your card and then your desired credit limit and income. If you want triple, enter triple your current limit.