Credit card Q&A: “Are credit cards bad for your credit score?”

In short, no, opening a credit card won’t hurt your credit score, at least not in the long run.

Sure, you may see your credit score get dinged a few points when you apply for a credit card, but this is standard practice when you apply for any type of loan.

Be it a credit card, auto loan, mortgage, or any other type of loan.

Essentially, any time you make a request for new credit, you heighten your credit risk. Don’t confuse this with checking your own credit score, as that doesn’t involve new credit and will not hurt your credit score.

[How many credit inquiries is too many?]

The general thinking is that those in need of credit, whether for good reasons or bad, are less financially healthy than those who don’t need new credit.

It’s a harsh rule, but obviously it’d be pretty darn complicated to make the whole process entirely subjective. And like anything in the credit realm, it largely depends on your unique situation.

Everyone has a different credit profile, so the opening of a credit card could be good or bad depending on your previous actions.

Let’s look at an example:

Imagine if someone had very little credit history and decided to open a credit card.

While it may have been difficult to get that initial approval, thanks to a lack of credit history, the new credit card could lead to a healthier, good credit score in the future.

You see, “length of credit history” and “types of credit used” are important factors in determining your FICO score.

So without a decent mix of credit and a few years under of it your belt, your credit score will actually suffer. If you open a credit card account and make timely payments, you’ll add to that history and credit mix.

Not only that, but if you keep the balance low, you’ll improve your credit utilization (more available credit) and your credit score further.

Conversely, if you’ve already got 10 credit cards open and plan on opening number 11, you may want to think twice. Having too many credit card accounts can be detrimental to your credit score (and your bank account).

[How many credit cards should I have?]

I’ve Opened Numerous Credit Cards in a Short Period of Time

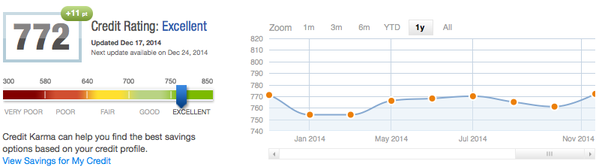

If you’re looking for a real-world example, I can tell you that I’ve opened several credit cards in the span of a few months and my credit score is still excellent.

However, there was a period of time when my score was depressed because of all the newly opened accounts. But because I kept balances relatively low and well below my credit limits and always paid off my credit cards in full, my credit score eventually shot higher.

In fact, my credit scores are even higher (check out the graph above) after all the new credit cards I applied for. But again, only because I was an extremely responsible borrower.

In summary, don’t be afraid to open a credit card if you want/need one. While there may be an initial hit to your credit score, it should be fairly inconsequential. And healthy credit habits practiced over time will ensure your credit score keeps moving higher and higher.

After all, without credit history you won’t have a credit score, so it’s a bit of a catch-22.

Just be sure to always make timely payments, keep credit card balances low, and apply for new credit sparingly.

Lastly, if you’re planning on applying for a major loan in the near future, such as an auto loan or a mortgage, you may want to hold off on opening a new credit card account to avoid the associated ding. But once your loan closes, you can apply for that credit card.

Read more: Should I close my credit card?

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

- Best Gas Credit Cards – Earn Up to 8X Points! - February 15, 2023