I’ve already talked about good credit scores, so the next logical question is, “what’s a bad credit score?”

Whoa there! Before we talk numbers, it’s important to note that we’re talking about FICO scores, which are the most commonly used credit scores by lenders. In fact, it is believed that about 90% of them rely on the mighty FICO score.

In short, FICO scores range from 300-850, with higher scores representing a lower risk of default. In other words, the higher the credit score, the better off you are in the eyes of potential creditors.

So back to our question. Well, much like all things credit, it’s hard to pin it down to a bad three-digit number, as it’s more subjective than that, but it’s safe to say bad credit scores fall below 620.

In the mortgage world, credit scores below 620 are considered subprime, meaning the borrower’s credit is of substandard quality. Of course, you can be considered subprime if your credit is below 400 or as high as 619, so it’s quite a wide range.

The takeaway is that your credit score is not where it should be, and actually well below average, limiting your ability to get approved for a credit card, auto loan, mortgage, and so forth.

If you do happen to be approved, you’ll likely be stuck with a much higher interest rate than what you would have received with a decent credit score.

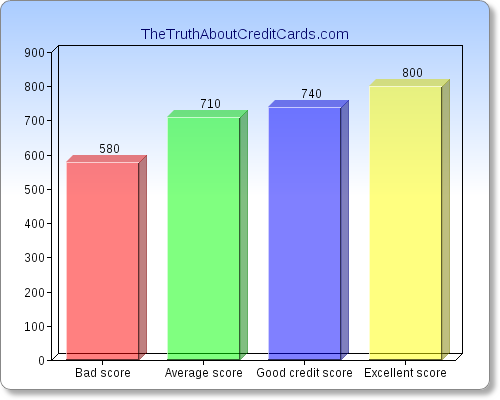

Excellent credit score: 800

Good credit score: 740

Average credit score: 710

Bad credit score: 580

Why Is My Credit Score Low?

If you’ve got a bad credit score, you’ve likely got some missed payments, or perhaps even a collection or a charge-off to your name. Put simply, creditors view you as a serious credit risk because you’ve made some mistakes in the past and are likely to commit the same missteps in the future.

As a rule of thumb, the lower your credit score, the more mistakes (or more severe) you’ve made.

It could also be that you have limited GOOD credit history on your credit report, and what is there is downright bad. This lack of goodness can also send your credit score down in a hurry.

Of course, major delinquencies such as missed mortgage payments, short sales, foreclosures, and bankruptcy will most likely land you in bad credit score territory in no time at all. So don’t be surprised if you committed one of those aforementioned credit sins.

Whatever it is that’s holding you down, you’ll want to sort it out sooner rather than later to ensure it doesn’t cost you real money.

How to Turn Things Around

If you’ve got a bad credit score, consider checking out some ways to improve your credit score. It’s not as hard as you may think, though it does take time to nurse a bad credit score back to health, so be patient!

The first step starts with ordering a free copy of your credit report to determine why your credit score is low to begin with.

Often times you’ll find that there are mistakes on your credit report, such as erroneous medical collections. If you find this to be the case, you should attempt to remove those negative items from your credit report as soon as possible.

If you sign up with the so-called free credit report companies via their free trial, you can dispute items on your credit report with a simple click of your mouse. The credit bureaus also allow you to dispute items on your credit report. Both online and offline.

Even if the information is accurate, if the original creditor is unable (or doesn’t bother) to prove the item in question is indeed delinquent, it will be removed.

This is probably the quickest way to send a bad credit score to average or even good territory in mere weeks. But if you legitimately slipped up and your creditors confirm this, don’t expect your score to improve at all.

Let’s look at a quick example of how you can turn that bad credit score around:

Current credit score: 580 (bad)

Negative item on credit report: unpaid medical collection

Credit score after successful dispute: 660

If you dispute the item successfully, your 580 credit score, which I consider “bad,” could climb to 660 or higher, which I consider an average credit score, albeit lower than the national average.

The result would be more approvals from credit card issuers, banks and other lenders, and lower interest rates on said lines of credit.

Once you’ve reviewed all the negative aspects of your credit score, look at any comments from the bureau(s) on the report. These are usually one line comments at the end of the credit report that detail any issues affecting your credit score. You may see things such as:

– number of inquiries adversely affected the score

– too many credit inquiries last 12 months

– time since delinquency is too recent or unknown

– number of accounts with delinquency

– time since most recent account opening is too short

– number of bank or national revolving accounts with balances

– proportion of balances to credit limits is too high on bank revolving or other revolving accounts

These comments are usually pretty clear indicators that will help you pinpoint your credit problems.

A couple of the above have to do with inquiries, some specifically in the last 12 months. If you keep applying for credit cards, loans, mortgages, etc, your credit score will drop. While it’s been said that multiple inquires related to the same transaction don’t affect your score, applying for multiple credit cards and other loans at the same time or in high intervals will lower your credit score.

Recent Delinquencies Are Bad News for Credit Scores

Another has to do with recent delinquencies and delinquencies in general. Any recent late payments will lower your credit score, though the effect will weaken with time. And the less credit depth and history you’ve got, the more impact one late will have on your overall credit score. Also, if you have a large number of delinquencies, your credit score will be low.

Related to that, one of the messages above involves time since most recent account opening. Any new credit accounts can lower your credit score in the short-term, although your credit score will rise over time with regular, on-time payments. If your credit accounts are all new, less than say two years old, your credit score will be somewhat depleted as well.

High Balances Will Lower Your Credit Score

The final two messages above relate to high balances, and the proportion of balances to credit limits (credit utilization). Basically it refers to any accounts that are near their limits, and the proportion of available credit versus the aggregate of your credit lines. If you’ve got maxed out credit cards and 90% of your total available credit exhausted, your credit score will be low, even if you pay everything on time.

Review the above, and make sure you pick apart your credit report and verify the reporting from all three major credit bureaus. Once you’ve got a handle on what’s bringing your credit score down, you can start rebuilding your credit, and raising your score. Keep in mind that credit building and improvement takes time, which is one of the measures for establishing a good credit score, so be patient!

If you continue to practice healthy credit score habits, before you know it you could achieve an excellent credit score. So don’t be discouraged if your credit score isn’t quite up to snuff. They aren’t set in stone and there’s always time to turn things around for the better.

Tip: Paying down a high balance and keeping balances low is a great way to boost your credit score, but on-time payments are most important.

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023

Successful disputes are the key to turning a bad score around. Most of the people I help have a collection or late payment that we can get removed with ease.