It seems everyone is always looking for results overnight, whether it be a new diet or a get-rich quick scheme.

Unfortunately, meaningful results take time (and work), and the same is true for your increasingly important credit score.

While making on-time payments is the most important factor behind all credit scores, including both FICO and VantageScore, credit history is also extremely important.

Why Does Average Age Matter?

If you think about, your credit score needs time to develop and prove itself. After all, without time you really haven’t demonstrated anything.

Sure, someone could make on-time payments for 12 months, or even two years. But then all of a sudden fall off the wagon, charge up their credit cards and overextend themselves until the cows come home.

If someone makes on-time payments for 10 years, they’re clearly going to be a lot more apt to continue doing so.

By no means are they bulletproof, but in the eyes of new creditors they are going to be more reliable than the person who has made on-time payments for just one year.

I alluded to this in my good credit score article, which focuses on attributes beyond the numerical score itself.

Let’s look at an example to illustrate what I’m talking about.

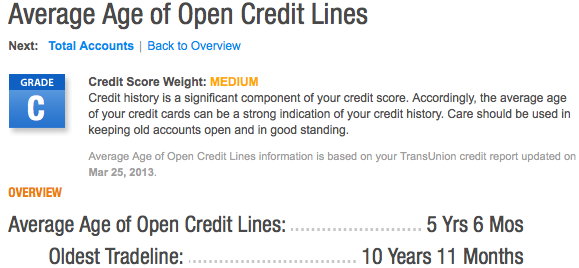

As you can see from this Credit Karma sample credit report card, average age of open credit lines is a medium ratings factor. In other words, it’s important.

This individual has an average age of 5 years and 6 months on their open accounts, meaning if we look at all the open accounts on their credit report, they’ll be roughly five years old.

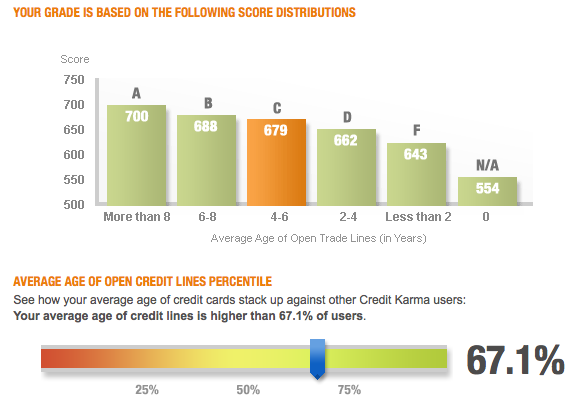

While it’s not bad, it still puts them in the middle of the pack with regard to credit score distribution, and it earns them a lousy “C” letter grade for this factor.

Their average age of accounts is actually better than 67.1% of other Credit Karma users, but still not the best it can be.

It’s not until credit accounts are 8+ years old on average where individuals seem to get full credit in this department, despite most of the population having accounts with an average age between 2-4 years.

What You Can Do

The solution to this “problem” is actually very simple, though not necessarily easy to accomplish.

If you want the average age on your accounts to be older, simply keep older accounts open and avoid opening new accounts.

[It’s okay to cancel your credit card.]

Oh, and wait for lots of time to pass. This is really the only way to maximize your credit score in this key category.

This explains why older folk tend to have higher credit scores than those just starting out.

Also note the new accounts bit – for FICO scores, it’s also a key factor, so taken together, the impact to your score is even greater.

And if you factor in the credit inquiries associated with new accounts, the effect is even more powerful.

So individuals who apply for new credit and open new accounts in a short period of time or rather haphazardly will see it in their credit scores (drop!).

Over time, that can change as the accounts age, but the near-term impact can be problematic.

At the end of the day, if you want to achieve truly excellent credit, time is an ingredient you cannot ignore.

Read more: How to build credit history.

- Make Sure You Have a Premium Chase Credit Card so You Can Transfer Points! - February 21, 2025

- Do Capital One Credit Cards Have a 5/24 Rule Too? - February 23, 2023

- Quickly See the Many Ways You Can Use American Express Membership Rewards Points - February 21, 2023