Whether you’re a credit noob, or a seasoned pro, there are two important things you should do every time you open and close a credit card.

I thought of these things after I opened a slew of new credit cards to earn a bunch of awesome sign-up bonuses.

If you’re also churning and burning, you might want to take note of these tips.

It was getting somewhat stressful to keep track of everything, so I came up with a plan to get my ducks in a row.

Set a Reminder to Close the Credit Card Within a Year

The first thing you should do is set a reminder about one year (actually a little less) from your card approval date.

You don’t need to close the card. You might love your new card. But it’s still good to set the reminder.

This anniversary date can be significant for a number of reasons, but is often most important if you must pay an annual fee each year to keep the card.

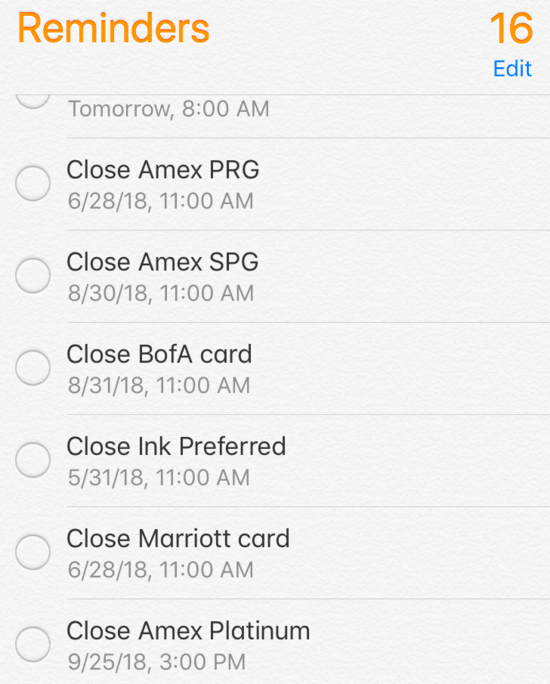

I use Reminders on Mac to send me a notice when my annual fee is about to hit the credit card in question. Similar services are available for other operating systems.

Instead of going back months later and wondering when I opened the card, when it was approved, etc., I simply set a reminder the very day I am approved for the card, even before I receive the card in the mail.

You can also “star” the welcome or approval e-mail in your inbox. This way it’ll be easy to find if you need that key date.

This tends to be the date card issuers use to establish annual fees, sign-up bonuses, and so forth.

Set a Reminder with the Credit Card Open Date for Sign-Up Bonus Purposes

Speaking of that sign-up bonus, setting a reminder can also help you time your minimum spend.

If you have three months or 90 days from account opening, you can easily add a note to the reminder with the open date as well.

That way you have two critical pieces of information to reference if and when necessary.

Or do a separate reminder just to keep track of the minimum spend cut-off date.

To give myself a buffer, I set the date of the reminder a week or two back from the full 90 days so I don’t accidentally screw up and miss out on my sign-up bonus.

It’s a simple task and one that will alleviate some stress.

It’s also a nice way to keep track of credit cards you open, if you happen to forget about one. Trust me, it happens…

You can also stay on top of your 5/24 status this way as well!

Move or Use Your Cash Back or Points Before You Close the Account

Now let’s say your first year is almost up, and you decide not to renew your credit card for year two.

This is a common situation, and one a lot of folks have weighed lately with cards like the Amex Platinum and it’s near-$700 fee.

Many credit cards these days are very expensive to keep in your wallet.

And often the first year tends to offer the most benefits, then they kind of decline as time goes on.

Assuming you get your reminder and it’s been nearly a year, you might want to go ahead and cancel the card.

If so, make sure you move your points or cash back or whatever currency it is you’ve earned to another card or loyalty partner before you do.

Or simply cash out the money or points before canceling. Whatever you do, do something! Don’t let your points expire!

Tip: Credit card issuers typically give you a grace period of 30 days to use the points before you lose them forever. Have a plan ready around year two to avoid any missteps or lost opportunities.

Reallocate the Unused Credit Line

Lastly, when you cancel a card, make sure you actually hang onto the credit line that was tied to the card.

This is pretty easy to do if you have other credit cards with the issuer in question.

Simply ask them to move your credit line from the card you’re canceling to a card you plan to keep.

This can improve your credit scores, or at least protect them from sliding as a result of lost credit.

It could also instantly lower credit utilization on a card that had a relatively small credit limit.

For example, I closed Chase Sapphire Reserve and moved that credit line to my Chase Freedom, which I keep open because it’s annual fee-free.

I believe I had to move some of my credit line from Chase Freedom back in the day to open another Chase card, so the credit limit was restored and a lot higher.

This means I won’t have to fret if I spend a couple grand on the card and the credit limit is only a paltry $5,000.

Bank of America Credit Cards Might Be the Exception

The one exception is Bank of America credit cards – they have a weird process where your credit line is essentially frozen for something like a year after closing the card.

So if you try to open a subsequent BofA credit card shortly after, you might not have the available credit to do so.

In other words, if your credit line were say $15,000, ask to lower it to whatever the minimum is, then close the card.

That way if you open another BofA card within a year you won’t have that phantom credit tied up.

In summary, opening, holding, and closing a lot of credit cards at once doesn’t have to be stressful.

If you set some reminders and remember a few simple rules, you can reap the rewards and avoid mistakes.

And make life a whole lot easier for yourself in the process.

Tip: You can also create a spreadsheet with credit card opening, closing, and sign-up bonus dates to use as a reference over time.