I have an Ameritrade account and the other day upon signing out I was shown an ad for the “TD Ameritrade Client Rewards credit card.”

To be honest, I didn’t even know they offered a credit card, though it’s not in the least bit surprising.

after all, Toronto-Dominion Bank is a very large Canadian financial institution with ambitions to snag more U.S. business, including the highly lucrative credit card market.

I figured it’d be prudent to take a look at what the card offers to see if it’s a worthwhile application.

TD Ameritrade Client Rewards Offers 1.5% Back on All Purchases

- While not the best cash back rate available

- Thanks to a variety of 2% cash back credit cards

- The TD Bank credit card does offer 1.5% cash back

- Which is higher than many other options, along with a $100 bonus

First off, the biggest draw of this card seems to be the 1.5% cash back on all purchases, every day.

There aren’t any rotating categories to keep track of and there aren’t any caps or limits to the cash back you can earn.

That’s pretty straightforward. To sweeten the deal a bit, you get a 10% bonus when you redeem your cash back into an eligible TD Ameritrade account.

In other words, your 1.5% cash back rate jumps to 1.65% cash back if you throw it into one of your investment accounts.

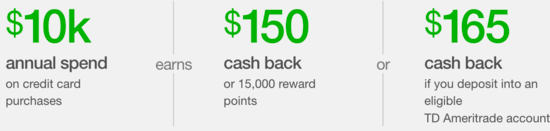

For example, if you spend $10,000 on the card, you’d earn $150 cash back. If you deposit that cash into Ameritrade, it increases to $165.

The TD Ameritrade Client Rewards Credit Card also offers a $100 sign-up bonus if/when you spend $500 in the first 90 days.

That’s pretty easy to do for most folks, so it effectively increases your cash back rate during year one.

Is 1.5% (or 1.65%) Cash Back Enough?

- You actually get a slightly higher cash back rate

- If you spend $10k annually and deposit the cash into

- An eligible TD Ameritrade account

- But again there might be better options available

There’s just one problem here. The 1.5% cash back rate (or even 1.65%) falls short of what many other credit card issuers currently offer.

For example, you can get 2% cash back on every purchase with Citi Double Cash. Or you can get 2% cash back if you deposit your rewards into a Fidelity account with the Fidelity Visa.

That means Ameritrade is getting beat by a major issuer and another investment-minded credit card from its big rival Fidelity.

Why then would you choose this card if you can make more with the other cards? Well, I can’t answer that question because there’s not a good answer.

Accepting less cash back doesn’t make a lot of sense, or cents, so for me this card is a pass.

TD Credit Card vs. Fidelity and Others

- Ultimately the TD credit card doesn’t lead the industry

- In terms of cash back or sign-up bonus

- So there are certainly better options out there

- It probably only makes sense for those who have their money tied up in a TD account and don’t want to move it

For the record, I have the Fidelity Visa card and the only downside to that card versus the TD Ameritrade Client Rewards Credit Card is the 1% charge for foreign transaction fees.

Sure, that’s lower than the standard 3% fee that most issuers charge, but the Ameritrade credit card doesn’t charge any fees.

That could save you a lot of money and maybe even make up for the lower cash back rate, assuming you travel internationally a lot.

That’s my one gripe with the Fidelity Visa, though I have other cards I can use that don’t charge foreign exchange fees.

Fortunately, the Ameritrade credit card doesn’t charge an annual fee, another plus for those who want a card they can keep year after year.

But again, with several 2% cash back credit cards available, it begs the question why you’d choose this one.

You could earn your cash back via those other cards, then simply transfer the funds to your TD account after the fact and come out ahead.

It’s certainly not a bad credit card, it’s just that there are better options out there other than the TD credit card, so be sure to take the time to comparison shop.

(photo: Josh Plueger)