Citi just recently revamped its “Prestige Card,” which as the name suggests, is only reserved for the company’s wealthiest clients.

Well, if you’ve got $450 to spare on an annual basis, it’s for you as well, whether you’re rich or not.

So what makes this credit card so prestigious anyway? Let’s dig into the details to find out.

50,000-Point Opening Bonus Offsets the $450 Annual Fee

I hate to say it, but the first thing that jumped out at me with Citi Prestige was the staggering $450 annual fee, which isn’t waived for the first year. That’s how it wound up on my list of the most expensive credit cards.

There’s also a $50 annual fee for each authorized user. Compare this to the $450 annual fee on the Amex Platinum Card, or the $95 annual fee on Chase Sapphire Preferred.

So there must be some good rewards here if you’re paying $450 just for the privilege of carrying the card in your wallet, right?

Well, part of that $450 is offset thanks to the 50,000 ThankYou Points opening bonus offered with Citi Prestige.

If you spend $3,000 within the first three months of account opening, those 50,000 points are good for $500 (or more) in statement credits, travel, gift cards or other merchandise.

Look Out for the 100,000 Bonus Point Offer!

While 50,000 bonus points is great, 100,000 bonus points are even better. If you look around, you might be able to find the 100k sign-up bonus after spending $3,000 during the first three months from account opening.

Clearly this is a much better deal, though you do seem to need to be targeted to get this enormous bonus.

Fortunately, there are plenty of simple ways to spend that kind of money without getting into debt.

Alternatively, there’s also a 50,000 sign-up bonus from the Citi ThankYou Premier Card that when combined with Prestige would give you 100,000 points after you make $6,000 in purchases within the first three months of account opening ($3,000 per card).

And that card waives the annual fee the first year, and only charges an annual fee of $95 after that.

Citi Prestige Is a Travel Rewards Credit Card

But fear not, Citi Prestige also comes with a $250 annual statement credit for airline fees, such as in-flight food and beverages, baggage fees, and upgrades.

Oh, and airline tickets! So you can just buy flights every year and knock the annual fee down to $200. Now it’s looking a lot better.

Tip: To maximize this benefit, apply for the card during the second half of year one, buy an airline ticket, then get another airline ticket early in the following year so you can earn two $250 credits while only paying one annual fee!

Still not enough? You also get a complimentary economy-class companion ticket to any destination in the world when you book a full-fare ticket via Citi’s travel benefits provider.

You can also book discounted airline tickets through Citi at 15% off.

And that’s not all. You earn Flight Points for every mile flown, at one point per mile.

The catch: ThankYou Flight Points are not transferred to your ThankYou Member Account unless you earn an equal or greater number of ThankYou Points from purchases.

So you can’t just fly all over the world and accrue Flight Points without actually using the Citi Prestige card for purchases.

These benefits are no longer offered in lieu of new perks.

The card also provides a ton of travel benefits, such as airport lounge access, dedicated airport concierge service, and a $100 Global Entry application fee credit (expedited traveler program).

How to Earn Points with Citi Prestige

You get one ThankYou Point for every dollar spent, and double points at dining establishments and on entertainment, including fancy restaurants and fast food restaurants, and triple points on air travel and hotels.

- 3X ThankYou Points on air travel and hotels

- 2X ThankYou Points at restaurants and on entertainment

- 1X ThankYou Point elsewhere

As noted, you also receive Flight Points for each mile flown, and those translate to ThankYou Points if you spend enough on the card.

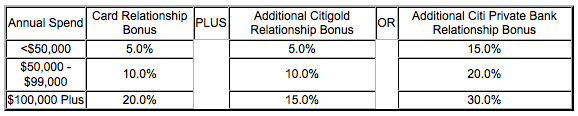

Additionally, there is a relationship bonus awarded at the end of each membership year (the date you become a cardholder).

For those who spend less than $50,000, a 5% points bonus is offered. So you’d wind up with 52,500 ThankYou Points.

If you spend between $50,000 and $99,000, the annual bonus jumps to 10%. And it rises to 20% for $100k annual spenders.

The bonuses get even bigger if you have a Citigold or Citi Private Bank relationship. Take a look at the big bonus percentages above.

There is no limit to the amount of points you can earn, and they do not expire.

And you get 33% more value for your ThankYou Points if redeemed for airfare via the Citi ThankYou Travel Center (or 60% more when used on American Airlines and US Airways flights).

So 50,000 points equates to 66,500 points, or $665 in value, or even more ($800) with those select carriers.

The Prestige Card Makes Sense If You Travel

In other words, if you like to travel, that $450 annual fee could easily be eclipsed with the many benefits offered via Citi Prestige.

There’s also the peace of mind of knowing your credit card will be accepted abroad, as it relies on chip-based technology, which is now the norm overseas.

You also won’t be subject to any foreign transaction fees with this card, another way to save some money.

Perhaps most importantly, ThankYou Points earned via Prestige can be transferred to airline partners, which is a huge plus for those looking to book award travel.

And their partner list seems to be growing all the time.

You also get complimentary access to American Airlines Admirals Club lounges, along with hundreds of other VIP lounges via Priority Pass Select, and a complimentary 4th night for any hotel stay, throughout the world.

And a $100 Global Entry application fee credit.

When it comes to the credit card APR, you’re looking at a variable 15.24%, with no promotional period for balance transfers.

That said, it’s not the card you want to carry a balance on, or use for balance transfers. It’s only good for those who pay their credit card balance in full.

So if you’re a world traveler and a big spender, Citi Prestige should definitely be included in your credit card search.

Tip: If you just want to earn straight up cash back, as opposed to travel rewards, take a look at the fee-free Blue Cash Everyday Card instead.

Prestige Perks in a Nutshell

50,000 ThankYou Points after spending $3k in first 3 months

3X points on air travel and hotels, 2X points on dining/entertainment, 1X elsewhere

$250 annual air travel credit (earn twice in 365 days)

Points worth 60% more for American/US Airways flights

Points worth 33% on other flights booked via Citi ThankYou Travel Center

Points can also be transferred to airline partners

Admirals Club lounge access for you and up to two traveling guests (or family) when flying AA

Priority Pass lounge access for you and up to two guests and/or immediate family

4th night free at hotels worldwide (unlimited)

$100 credit for Global Entry

15% off MasterCard Airport Concierge Service